Understanding and leveraging available tax incentives can significantly impact a company's bottom line. This article explores five powerful financial tools to reduce tax burdens and improve cash ...

A Tax Credit of up to $5,000 per Home

The Inflation Reduction Act has greatly enhanced the available incentives for constructing energy-efficient homes.

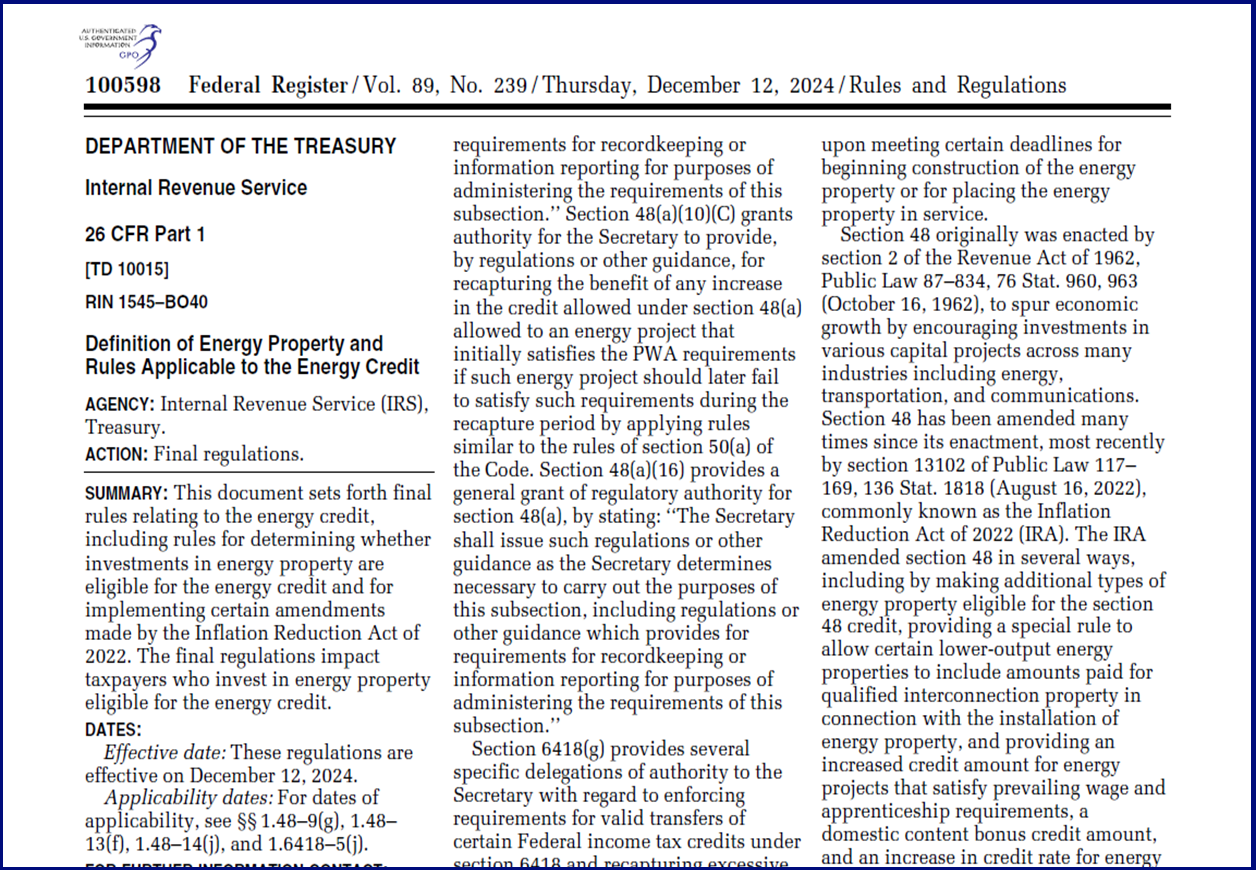

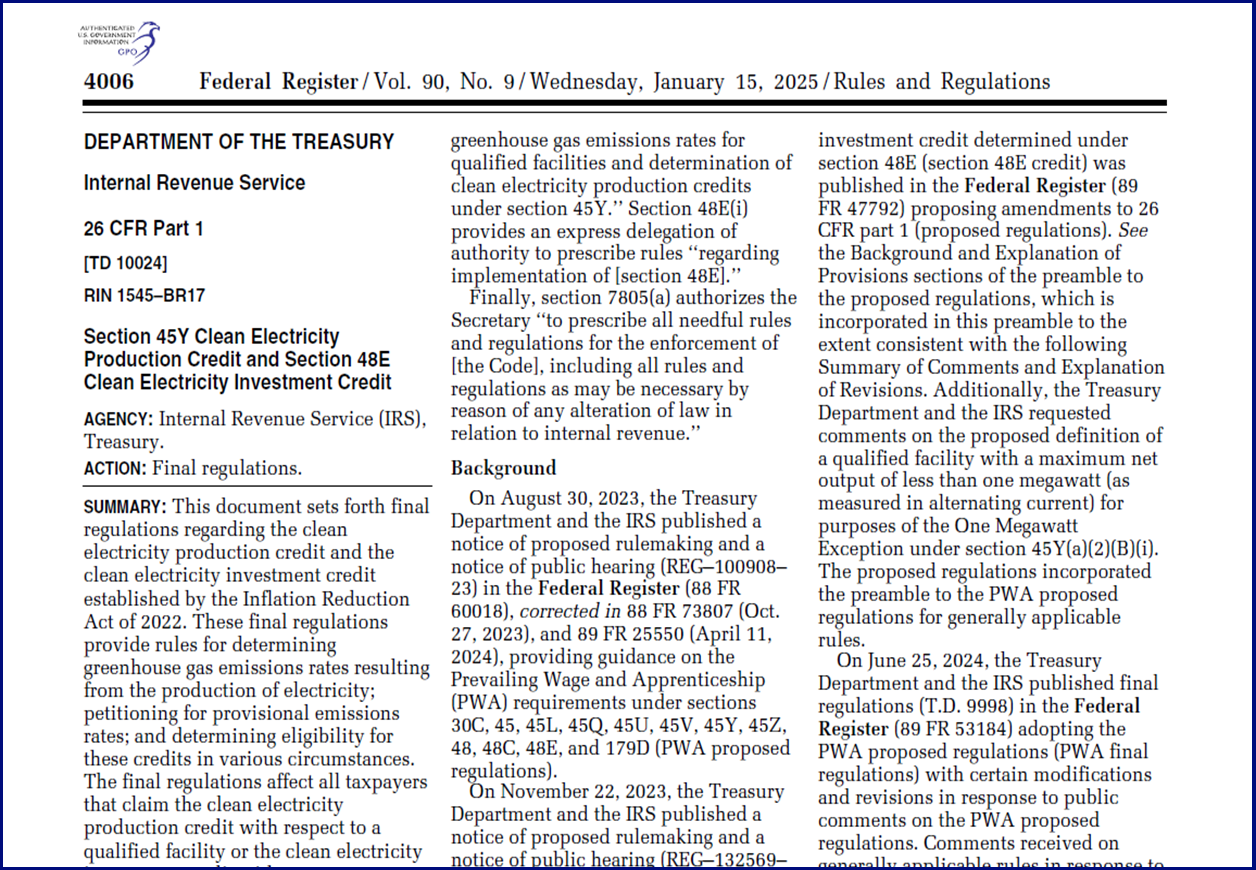

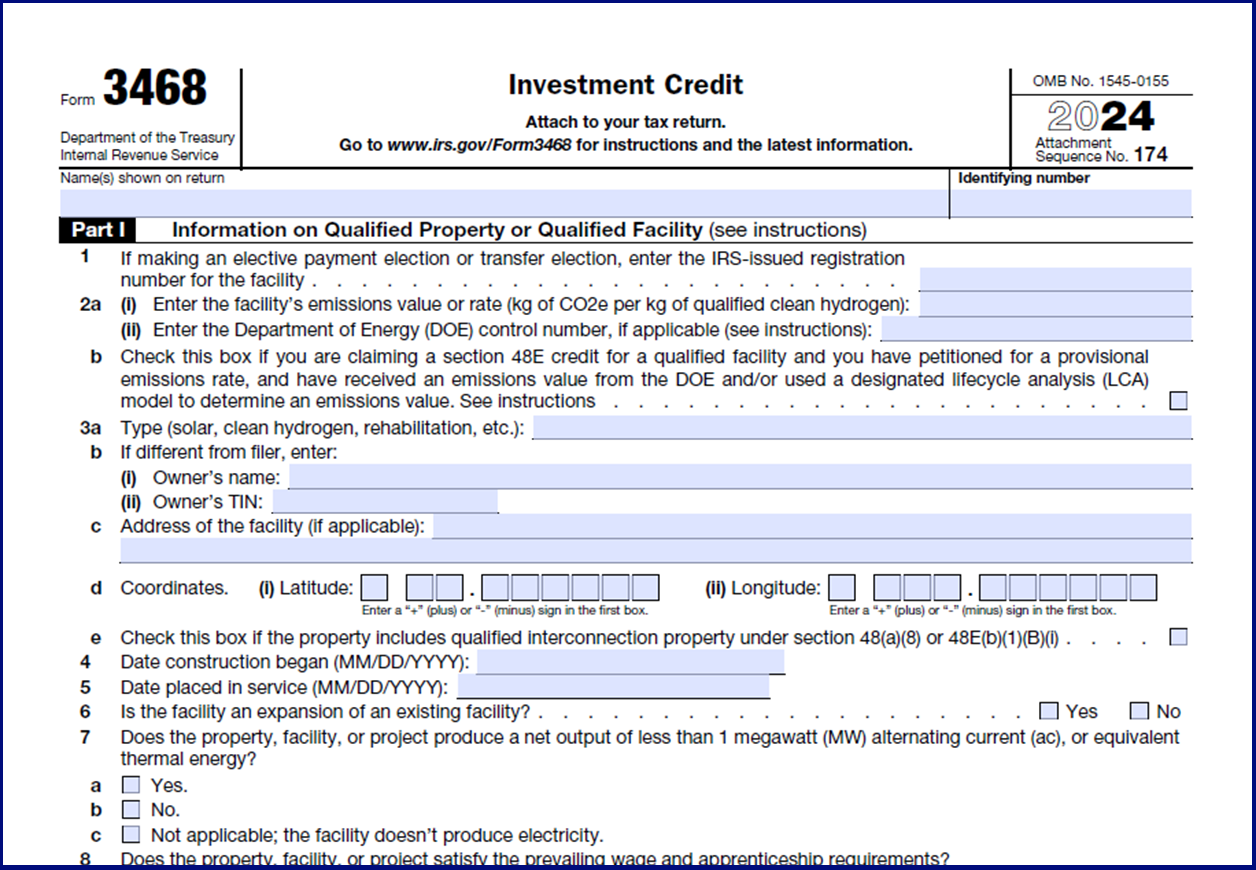

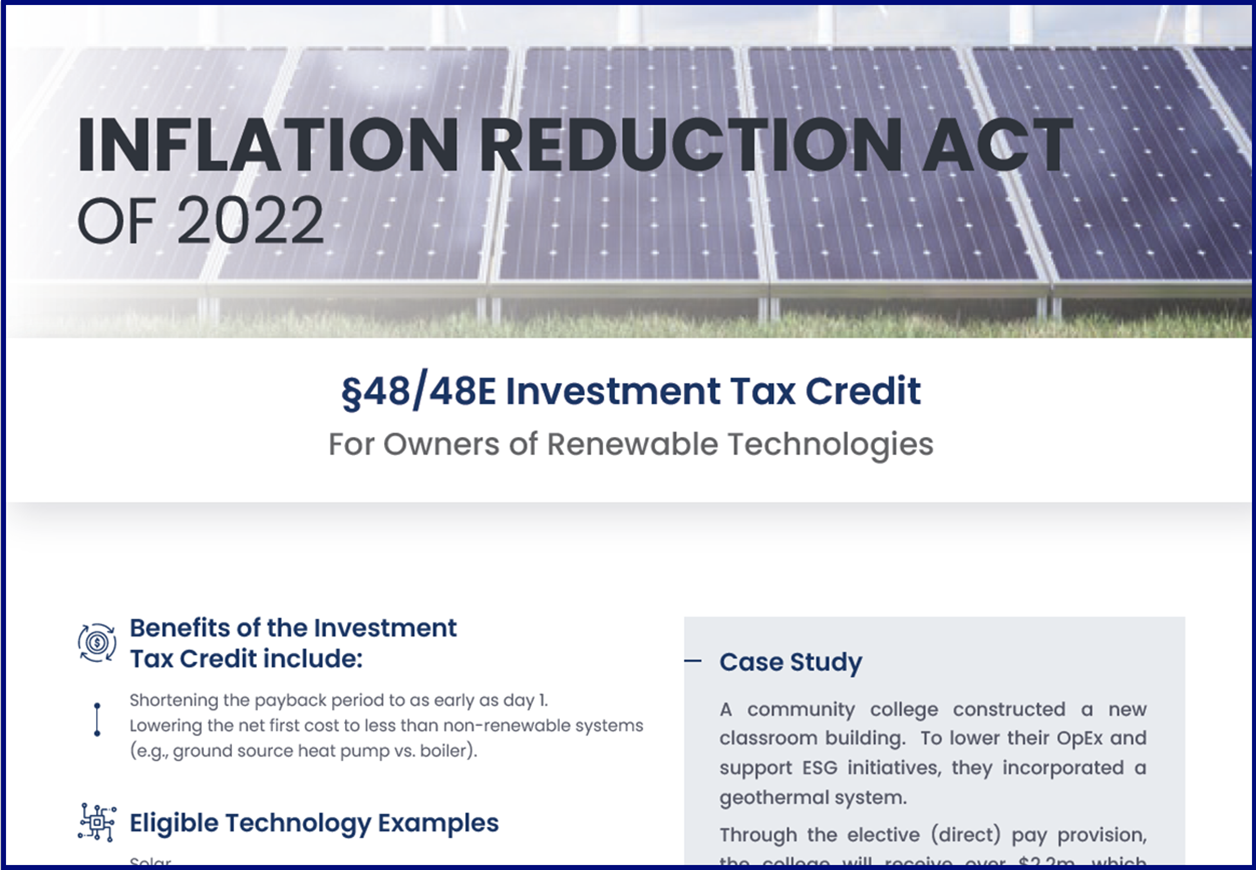

Additional Investment Tax Credit Resources

Below are links to downloadable fliers with additional investment tax credit information and case studies.

Schedule a Consultation

45L Tax Credit Knowledge Base

Blog topics covering the 45L Tax Credit, eligibility requirements, energy efficiency standards, and benefits for residential builders and developers.

The Section 45L tax credit, also known as the Energy Efficient Home Credit, is a significant incentive program designed to encourage the construction of energy-efficient residential buildings in the ...

The Inflation Reduction Act (IRA) of 2022 brought significant changes to the Section 45L tax credit, expanding its scope and increasing its potential benefits for builders and developers of ...

The Inflation Reduction Act (IRA) of 2022 brought significant changes to the Section 45L tax credit, expanding its scope and increasing its potential benefits for builders and developers of ...

The Section 45L tax credit, also known as the Energy Efficient Home Credit, was a significant incentive program designed to encourage the construction of energy-efficient residential buildings in the ...

This article is a comprehensive overview of the old and new Section 45L Tax Credit. The Section 45L tax credit, also known as the New Energy Efficient Home Credit, has experienced significant changes ...

©2025 FixedAsset.tax, Inc. All rights reserved. Privacy Policy