The One Big Beautiful Bill Act (OBBBA), signed into law by President Trump on July 4, 2025, fundamentally transformed the landscape of energy-efficient commercial building tax incentives, most ...

Find Your Fixed Assets Incentives

Discover the tax credits, deductions, and incentives available for your investments. Use our tool to determine what you qualify for and explore additional resources, including IRS regulations, forms, and case studies.

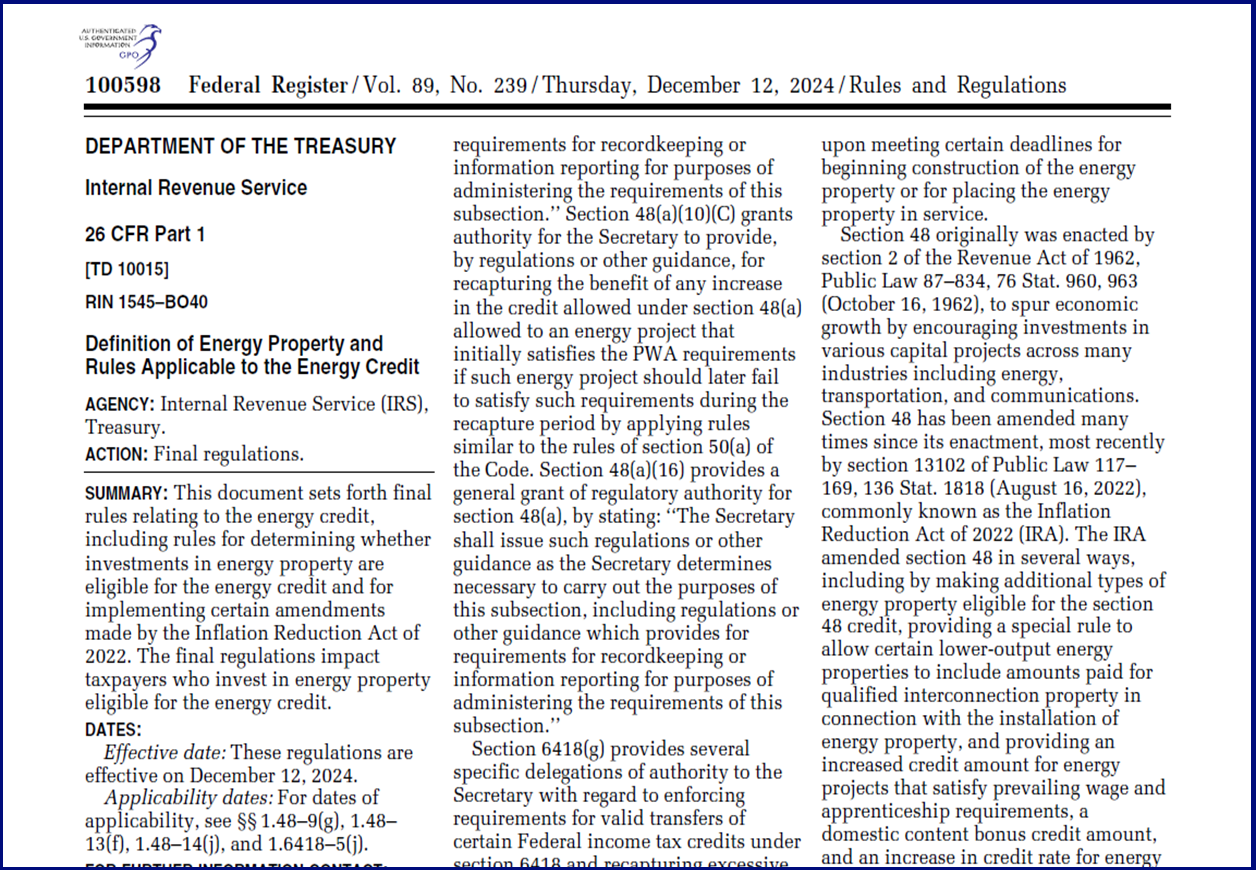

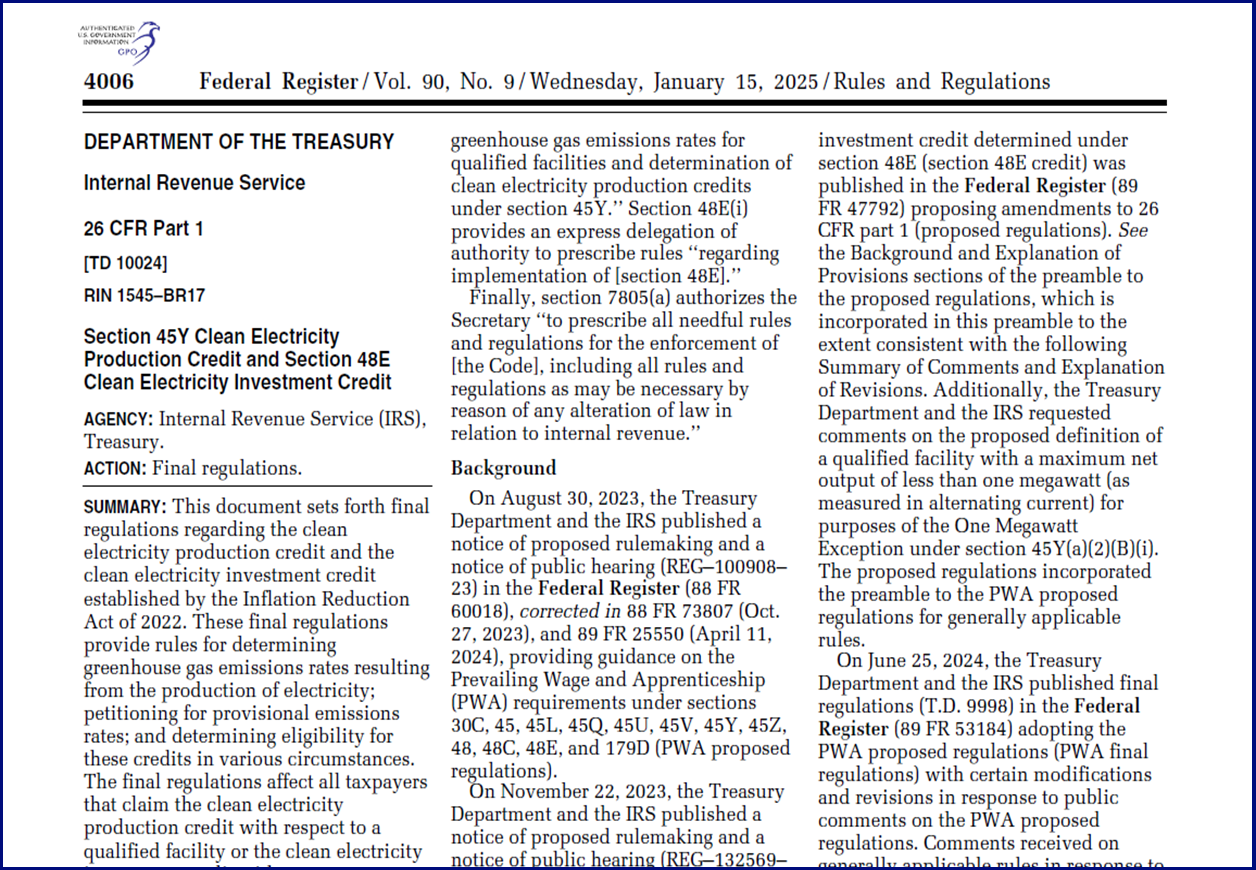

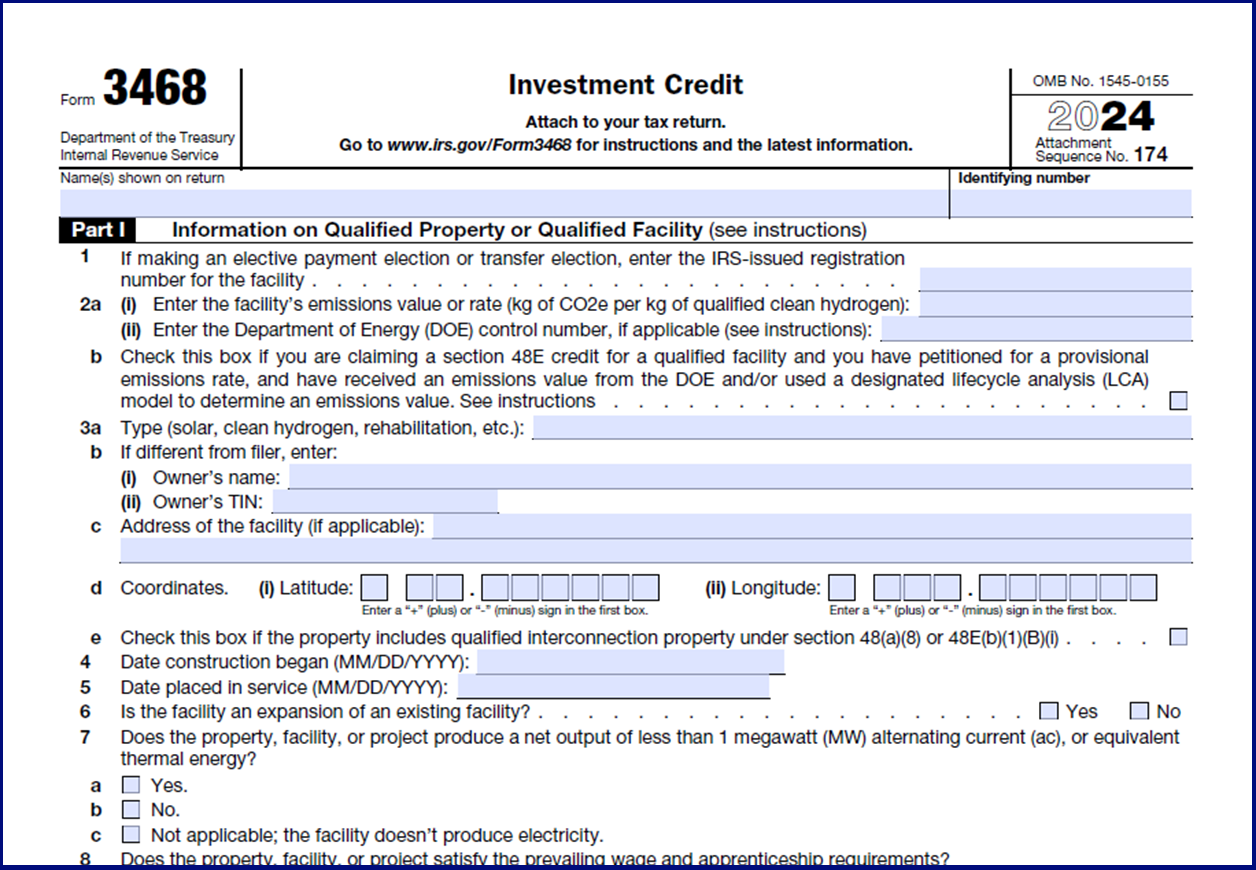

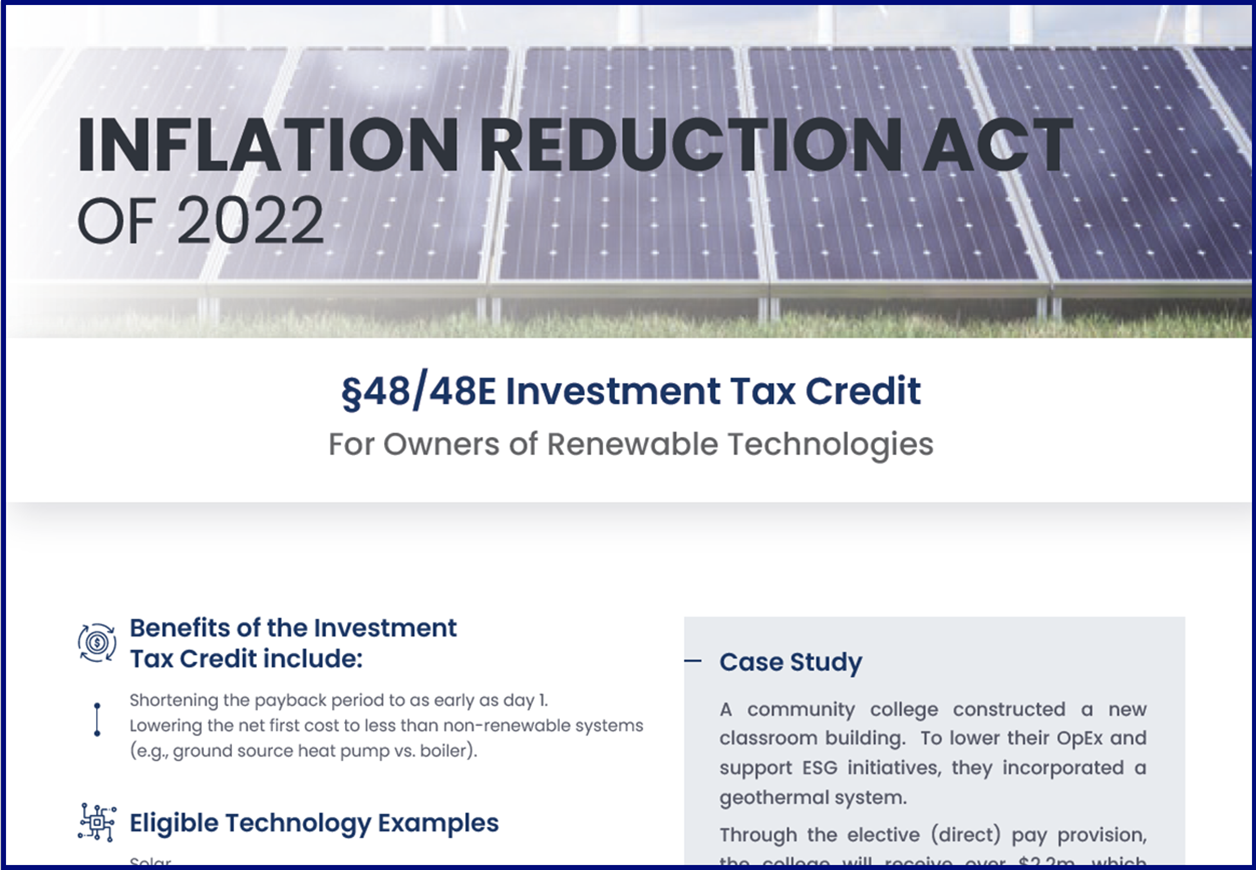

Additional Investment Tax Credit Resources

Below are links to downloadable fliers with additional investment tax credit information and case studies.

Schedule a Consultation

Fixed Asset Opportunity Knowledge Base

Blog topics covering credits, deductions, and incentives available for your investments.

Understanding and leveraging available tax incentives can significantly impact a company's bottom line. This article explores five powerful financial tools to reduce tax burdens and improve cash ...

The Section 179D tax deduction, also known as the Energy Efficient Commercial Buildings Deduction, offers significant financial incentives for designers of energy-efficient building projects. This ...

A cost segregation study on property placed in service in a prior tax year, also known as a "look-back" study, can offer significant benefits but also comes with some potential drawbacks. Here are ...

In the competitive landscape of auto dealerships, finding innovative ways to optimize financial performance is crucial. This case study examines how Johnson Automotive Group, a fictional ...

The Rural Energy for America Program (REAP) grant is an opportunity for agricultural producers and rural small businesses to invest in renewable energy systems, particularly solar installations. The ...

The Partial Asset Disposition (PAD) deduction has become an important tax strategy for businesses and real estate investors, allowing them to recognize losses on disposed portions of larger assets. ...

The Section 45L tax credit, also known as the Energy Efficient Home Credit, is a significant incentive program designed to encourage the construction of energy-efficient residential buildings in the ...

The Inflation Reduction Act (IRA) of 2022 brought significant changes to the Section 45L tax credit, expanding its scope and increasing its potential benefits for builders and developers of ...

The Rural Energy for America Program (REAP) loan guarantee is a vital financial tool offered by the United States Department of Agriculture (USDA) to support rural businesses and agricultural ...

©2025 FixedAsset.tax, Inc. All rights reserved. Privacy Policy